Irs penalty and interest calculator

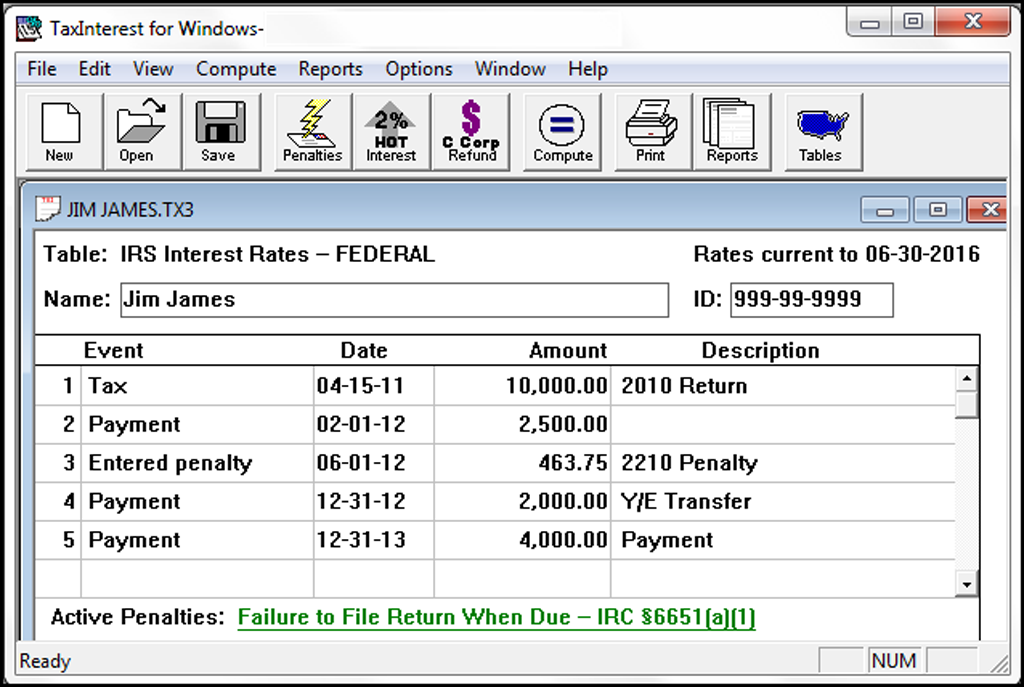

TaxInterest is the standard that helps you calculate the correct amounts. We calculate the amount of the Underpayment of Estimated Tax by Individuals Penalty based on the tax shown on your original return or on a more recent return that you filed on or before the due date.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

The amount of the.

. For more information. Taxpayers who dont meet their tax obligations may owe a penalty. Aggregate all the quarterly interest.

COVID Penalty Relief. Contact your local Taxpayer Assistance Center. Interest is computed to the nearest full percentage point of the Federal short term rate for that calendar quarter plus 3.

The IRS charges a penalty for various reasons including if you dont. The maximum total penalty for both failures is 475 225 late filing and 25 late payment of the tax. You may qualify for penalty relief if you tried to comply with tax laws.

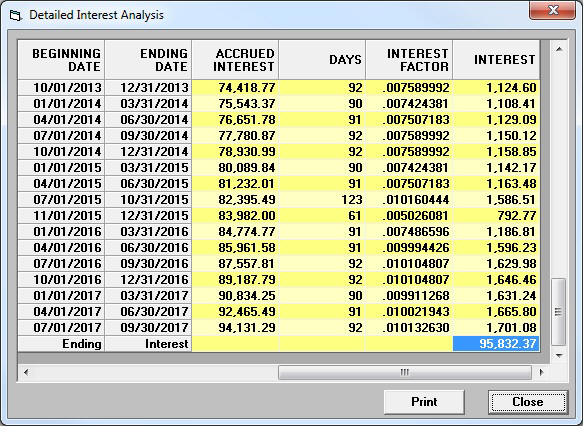

Call the phone number listed on the top right-hand side of the notice. This comprehensive program can be used for both income tax and payroll tax. For each quarter multiply Outstanding Tax with an interest rate.

Penalty and Interest Calculation. You will have to compute interest-based on IRS quarterly interest. If the delay in filing tax return is over 60 days late the minimum failure-to-file penalty is the smaller of 435 or 100 tax due.

Ad The IRS contacting you can be stressful. The penalty is 05 of the additional tax amount due and not paid by the due date for every month or portion thereof that the additional tax amount is not paid. This IRS penalty and interest calculator provides accurate calculations for the failure to file failure to pay and accuracy-related penalties.

Do not use this for IFTA taxes or for Individual Income or Fiduciary taxes with penalties owing. Penalty and Interest Calculator. - Personal Income Tax e-Services Center.

2018-07 by the amount owing. Calculate interest by multiplying the factor provided in Rev. The current IRS late fee schedule is from IRS Tax Tip 2017-51 which the IRS published on April 20 2017.

The maximum penalty is 25 of the additional taxes owed. This will calculate penalties and interest for individual income or fiduciary taxes such as for late-filed or late-paid returns. After two months 5 of the unpaid tax.

This file may not be suitable for users of assistive technology. For help with interest. To help taxpayers affected by the COVID pandemic were issuing automatic refunds or credits for failure to file penalties for certain 2019 and 2020 returns.

Interest Rate Categories and Formulas. Request an accessible. The tax shown on the return is your total tax minus your total refundable credits.

Different interest rates apply to underpayments and overpayments depending on whether youre an individual or a corporation. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems. This will calculate interest no penalties for most tax types such as for an amended return with additional tax due.

For details see COVID Penalty Relief. The Revenue Act includes provisions for charging penalty and interest if a taxpayer fails to pay a tax within the time specified. Please have your paperwork such as cancelled checks amended return etc ready when you call.

MyPATH functionality will include services for filing and paying Personal Income Tax including remitting correspondence and documentation to the department electronically. Enter the security code displayed below and then select Continue. The Department of Revenue e-Services has been retired and replaced by myPATH.

The interest calculation is initialized with the amount due of. The provided calculations do not constitute financial tax or legal advice. Use these tables to find the formula to calculate the rate for your type of interest.

The program includes interest rates from January 1 1954. Tax Underpayments Interest Formulas. The penalty is only 025 on installment plans if a taxpayer filed the tax return on time and the taxpayer is an individual.

Our IRS Penalty Interest calculator is. 39 rows IRS Interest Calculator. The following security code is necessary to prevent unauthorized use of this web site.

Interest and penalty calculator for the tax years ending 5 April 2003 to 5 April 2021. Most payments will go out by the end of September. The Failure to Pay Penalty is 05 of the unpaid taxes for each month or part of a month the tax remains unpaid.

Recommends that taxpayers consult with a tax professional. Looking For IRS Help. The penalty wont exceed 25 of your unpaid taxes.

For the minimum penalty fees a late taxpayer either pays 205 or 100 of the total unpaid taxes whichever is greater. The easy to use program is regularly being updated to include new penalties amended penalties new interest rates and other features. Ad Use our tax forgiveness calculator to estimate potential relief available.

Interest is calculated by multiplying the unpaid tax owed by the current interest rate. We charge some penalties every month until you pay the full amount you owe. We work with you and the IRS to resolve issues.

We calculate the penalty based on. Penalty is 5 of the total unpaid tax due for the first two months. This minimum amount is present when the late taxpayer filed more than 60 days after the due date.

In order to use our free online IRS Interest Calculator simply. If both a Failure to Pay and a Failure to File Penalty are applied in the same month the Failure to File Penalty will be reduced by the amount of the Failure to Pay Penalty. Interest calculator irs interest calculator compounded daily irs interest rates.

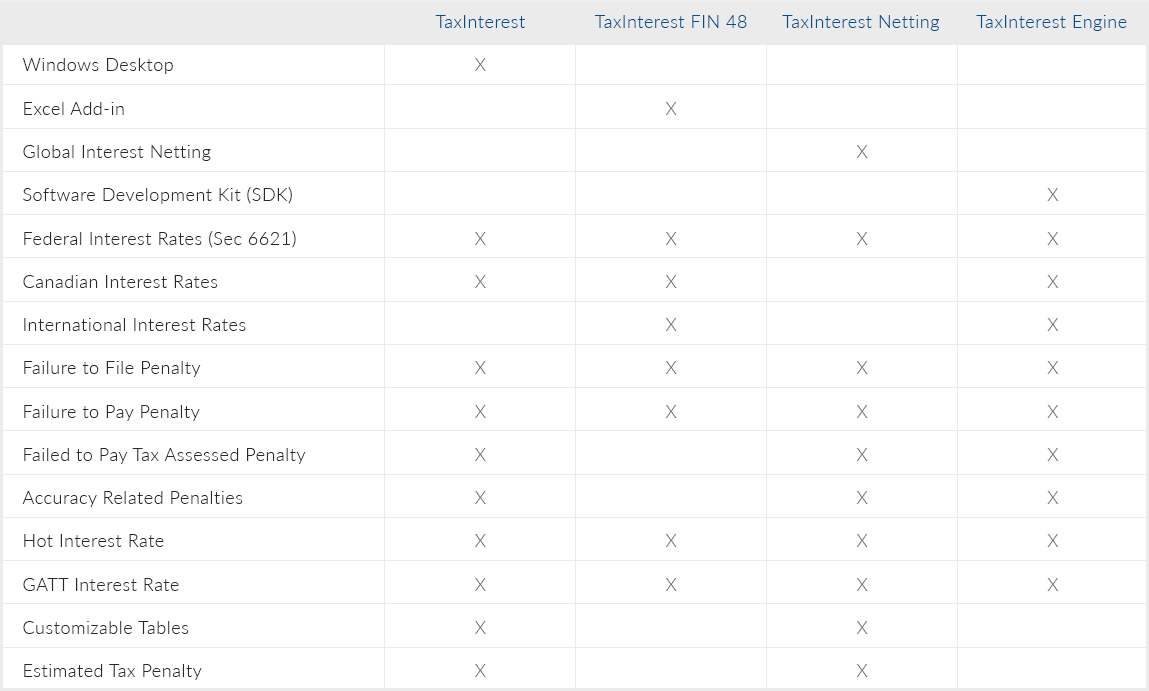

Ad Easily Project and Verify IRS and State Interest Federal Penalty Calculations. We may charge interest on a penalty if you dont pay it in full. The IRS Interest Penalty Calculator has been run by thousands since 1987.

Determine the total number of delay days in payment of tax. PDF 293 KB 1 page. Understand the different types of penalties what.

Thus the combined penalty is 5 45 late filing and 05 late payment per month.

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Easiest Irs Interest Calculator With Monthly Calculation

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Interest Penalty Calculator Uses Supported Penalties Reviews Features

Ofgtlaxwaacgjm

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Taxinterest Products Irs Interest And Penalty Software Timevalue Software

Fastest Irs Tax Penalty Calculator For Failure To File And Pay Tax

Tax941 Irs Payroll Tax Interest And Penalty Software Timevalue Software

Irs Penalty For Late Filing H R Block

Taxinterest Irs Interest And Penalty Software Timevalue Software

Irs Penalty And Interest Calculator 20 20 Tax Resolution Tax Pros

Irs Penalty And Interest Calculator Tax Software Information

The Complexities Of Calculating The Accuracy Related Penalty